Peach State Bank & Trust’s Gainesville headquarters got a new home earlier this year in Gainesville. Now plans are in the works for a new permanent branch in Braselton.

We have had a presence in Braselton since 2021 at a leased building just off Hwy. 211, but soon we’ll have our own home with frontage on Friendship and Thompson Mill roads when construction is completed in 2024.

“We believe our Braselton branch will benefit from even greater visibility once we complete construction of our new free-standing bank,” says Ron Quinn, Peach State Bank president.

Both of our locations are in the heart of the region’s bustling medical market, further strengthening our partnership with the healthcare community. Peach State Braselton will be a short distance from the Northeast Georgia Medical Center’s Braselton hospital and the surrounding medical offices.

“We have positioned our bank to support the medical growth wave in our community,” Quinn says. “We have already established strong customer relationships with several physician practices – in addition to investing in the next generation of local physicians – and look to continue to grow this part of our business.”

Our new Braselton location will also be convenient in providing community banking to nearby neighborhoods like Deaton Creek, Reunion, Hamilton Mill, and others in this fast-growing corridor.

While we’ve only been in Braselton for two years, our team there is already well-respected and connected. All our Braselton bankers have worked or lived in the market for many years and have strong relationships with the community.

Like our headquarters in Gainesville, the Braselton bank will offer our innovative “universal banking” concept, which features a modern, open lobby setting where we’ve eliminated traditional teller windows and waiting in line. As customers enter the bank, they are immediately greeted by friendly staff whom we’ve cross-trained to handle multiple services – from depositing a check or assisting with online banking to opening a new account. This approach makes for faster, more efficient trips to the bank.

We are excited to start building our permanent home in Braselton – and we’ll keep you posted on the progress once we break ground this summer.

LOCAL WINDOW ON THE ECONOMY

Community Banking, Local Economy Stand Strong

President & CEO

In a March Madness of another sort, the recent collapse of two national banks – Silicon Valley Bank in California and Signature Bank in New York – sent ripples of fear across our nation. Skittish depositors responded with brief runs on other large national banks before the federal government stepped in to calm nerves.

The U.S. financial crisis of 2008-09 apparently is still fresh on the minds of many. However, here at home and across Georgia, the impending storm of a full-scale meltdown seemed to dissipate well before reaching our borders. For the most part, it was business as usual in local bank lobbies and drive-throughs.

That is a testament to community banking and their strong hometown economies that so far have defied the looming threats of a national recession. Perhaps we in banking have learned lessons from the past in implementing much stronger due diligence and oversight of lending practices.

However, the biggest takeaway has been the strength of community banks and their symbiotic relationships with the local markets in which they operate. More simply said, large national banks are beholden to Wall Street. Community banks answer to Main Street.

I don’t mean to attack large multi-state banks with billions of dollars in assets. There is certainly a place for banks that are big enough to handle the huge transactions of the Fortune 100.

But the truth is that community banks handle 60 percent of all small business loans -- and 80 percent of agricultural loans – every day across the United States.

It’s important to point out that size does not define a community bank. Rather, it’s the location of the bank’s operations and its investment focus within the surrounding community. It’s like a partnership between the bank and its neighbors – with each benefiting from the other’s success.

There are 18 banks operating today in Gainesville-Hall County. Among them are a few community banks, but Peach State Bank & Trust is the only one based here. No matter the location, the common denominator among community banks is that they pump profits back into their local economies as opposed to a corporate office far away.

So, how have community banks survived – even thrived – through a pandemic, inflation and high interest rates that have tripped up mega-institutions with much larger balance sheets? There are several explanations.

For one, community banks are more nimble and responsive. The PPP loans of 2020 and 2021 provide a perfect example. Community banks serviced a disproportionate share of government loans for shuttered small businesses during the coronavirus pandemic. Peach State Bank, for example, was quick to set up systems and guide our customers through the application process while many national banks steered companies to a website portal to fend for themselves.

Much closer banking relationships are another reason. When you’re banking your neighbors, you know their character. You see their businesses down the street. And you have a better grasp on their likelihood for success and whether they’ll pay back their debts. It’s hard to spot these intangibles if you’re lending money to a hotel developer or a new retail store in another state.

Investment practices were another underlying factor behind the two recent national bank failures. SVB and Signature were working primarily with start-up businesses in technology and cryptocurrency markets that have been hit hard recently by the economy. In comparison, Peach State Bank’s commercial loans, which are spread across multiple business segments, represent about one-third of our overall loan portfolio. Similar to a balanced mutual fund, we keep a close eye on each lending source to ensure we are not heavily overweighted in any one segment. Our job is made easier by Gainesville-Hall County’s healthy diverse economy with industries ranging from manufacturing and food processing to healthcare and tourism.

In addition, publicly traded banks are under much more pressure to report stellar profits to their shareholders – which led banks like SVB and Signature to make riskier investments such as long-term bonds whose values dropped dramatically in the wake of the Fed’s historic succession of interest rate hikes. Privately held community banks like ours typically are more conservative with a balanced portfolio of local loans and shorter-term investments. In fact, Peach State Bank has consistently held the highest safety ratings for the last several years.

Finally, the local make-up of community bank boards provides an extra safety net. As a reflection of the bank’s own customers and community, they not only have keen insights but are also more approachable and trusted.

For all these pluses, perhaps that is why Kevin Hagler, who oversees Georgia’s Department of Banking and Finance, has said he would like to see a community bank in all 159 counties of our state. I believe Commissioner Hagler understands that in addition to instilling safety and soundness, community banks spur economic development that makes all our lives richer.

Ron Quinn, president and CEO of Peach State Bank & Trust, serves as the Georgia delegate for the Independent Community Bankers of America (ICBA) and is former chairman of the Community Bankers Association of Georgia.

From T-shirts to tumblers, local company has dressed up community for three decades

John and Lisa Geyer started J Geyer Advertising on their sun porch almost 30 years ago with two employees: John was the one and only member of their crackerjack sales team while Lisa ran the accounting “department.”

From that inauspicious start, the sun porch has since been replaced by a beautiful retail shop in downtown Gainesville and a thriving corporate promotions business. By their side for most of the way has been Peach State Bank.

In 1994, John left his career in banking to work in the screen-printing industry. His entrepreneurial itch eventually got the best of him, and he decided to start his own company. Lisa, who just had their first child, pitched in to get the new venture going.

“Over the nearly 30 years since then, we have worked really hard to hire a great team and build a rewarding business,” says Lisa, who praises her 15-member staff. “Without their hard work and dedication, we would not be where we are today. We are truly grateful and blessed.”

J Geyer Advertising offers custom screen-printed and embroidered apparel along with accessories and all types of promotional items. While their retail store is tremendously popular with high school sports fans, the majority of their business is custom promotional orders from large corporations, churches, and nonprofits.

The Geyers have been Peach State Bank customers since our founding in 2005 – and among our original shareholders as well. John formerly worked at Gainesville Bank & Trust (sold in 2007) where he and Lisa knew many of today’s Peach State employees.

“It’s the connection to a small-town bank that most influenced our decision to bank with Peach State,” Lisa says. “We have worked with many of the staff there, and those relationships remain crucial. It’s so nice to personally know the folks you’re dealing with.”

Serving locally owned businesses is an important role for community banks like Peach State. We are proud to be John and Lisa’s bank as they plan to celebrate 30 years in business.

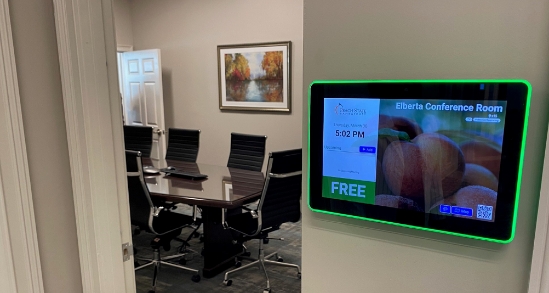

Conference Rooms Named

After Our Favorite Fruit

The meeting rooms at our new Gainesville headquarters are pretty as a peach – so, we’ve named each one after Peach varietals. Come check out the Georgia Belle room or the Elberta room the next time you meet with one of our bankers!

Through a job search on a legitimate employment website, a company offers you a job working remotely. Your new employer gathers personal information needed to enroll you as a new employee, then sends you a check to buy a new computer, desk and other supplies to set up your home office.

It seems like a great opportunity but it’s not, really. They promise you a job, but what they want is your money and your personal information.

Your new employer then contacts you and says they sent you too much money to set up your home office and asks for some of the money back. They say you can return the check or write them a check for the difference. In most situations, the person has deposited the check.

You return the money they requested and by doing so, you have given the imposters a check with your bank account and routing numbers and other personal information which opens you up to more potential fraud. Then there is no more communication from them, and you realize there is no job.

In many cases, these bad actors have hacked an account of a real company on an employment website to perpetrate the fraud to make it look legitimate.

With so many remote jobs out there, it can be easy to get caught up in a fraud like this. A good rule of thumb is if it does not feel right, then it probably is not.

Sarah Blalock, Vice President, Operations

Vice President, Operations

It’s not an exaggeration to say that Sarah Blalock has been with Peach State Bank since before it was a bank.

Sarah, our vice president of operations, is one of three original employees along with President and CEO Ron Quinn and Executive Vice President Terry Baker.

“I’ve been with Peach State since before the bank opened for business in 2005,” Sarah says. “I helped get the bank approved with the state and regulators.”

Sarah manages our deposit operations department, which oversees deposits, wires, automated clearing house (ACH) transactions, deposit account maintenance, and debit cards.

“Sarah has been an instrumental part of Peach State Bank & Trust since our first day of business,” Baker says. “She has served the bank in a number of capacities including heading up our compliance department as well as her current role as department head for Deposit Operations. Sarah exemplifies our motto “Because Service Matters” and we appreciate all that she does for the bank and our customers.”

Sarah is proud of the bank’s customer service and how the staff always goes above and beyond. She also is appreciative of Peach State’s support for a work-life balance among its employees.

“They allow us to always put family first in our lives,” she says.

As for her family, Sarah and her husband, Rickey, have been married 27 years and have a daughter, Shayla, 15. They also have two dogs, Molly and Zayn.

A native of Ellijay, Sarah moved to Gainesville in 1993 when she was 18. Having lived more of her life in Gainesville, she considers it more her hometown.

The Blalocks are an RV family, having traveled to 21 states. Sarah says they love camping on the beach, particularly at Sugarloaf Key’s KOA Campground in the Florida Keys, their favorite destination.

peachstate.bank

325 Washington St SW | Gainesville, GA 30501 | Phone: (770) 536-1100 | Fax: (770) 536-2525