We know that buying, selling, or building a home can be an exciting time. A home is more than just a structure; it is a dream, a future, and memories for you and your family. Here at Peach State Bank, you will find mortgage specialists who are friendly and knowledgeable. Whether you are purchasing or refinancing your personal residence, second home or 1-4 family investment property, we offer a variety of mortgage options, one of which should meet your mortgage needs.

Some of the mortgage loans we offer are:

- Conventional – Both Fixed and Adjustable (ARM) Rates up to $766,550.

- Jumbo – Both Fixed and Adjustable (ARM) Rates on amounts up to $3,000,000.

- FHA – Low down payments and relaxed credit standards as compared to conventional loans.

- VA – Low down payments and relaxed credit standards for veterans and military personnel.

- USDA Rural Development – Low down payments and relaxed credit standards for low to moderate income families in rural areas.

- Reverse Mortgage – Borrowers age 62 and over can convert the equity in their home into cash.

If you are not sure what you qualify for or already know exactly what you want, contact one of our experienced mortgage specialists. Click on the "Mortgage Documentation Checklist" to the right for a list of documents we will need to get started.

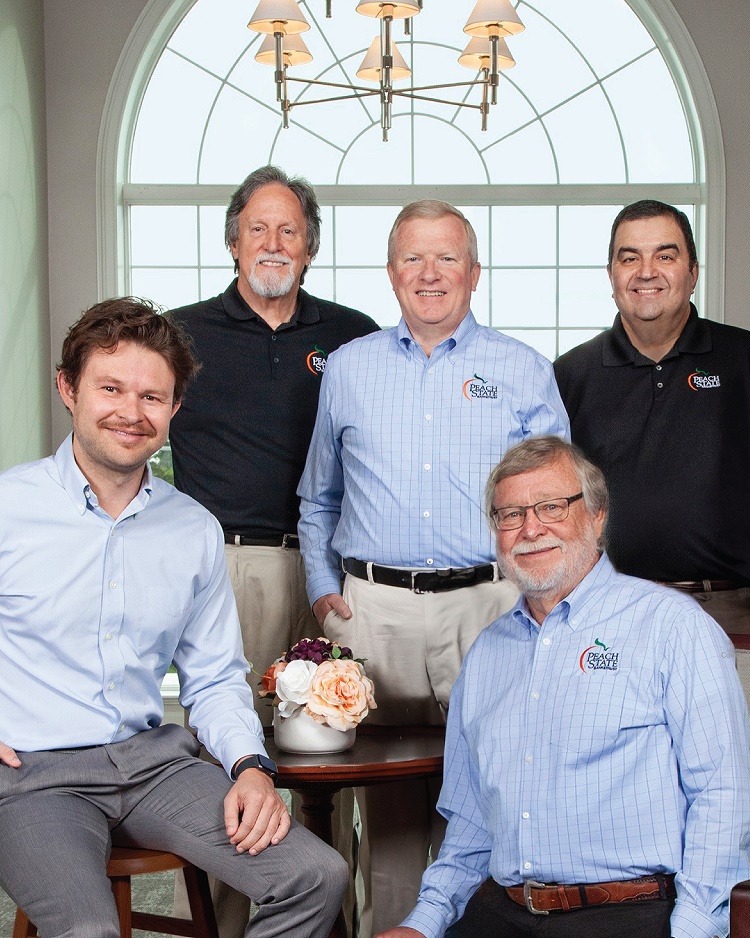

Front Row: Chase Hyder, Mickey Hyder

Back Row: Ken Crenshaw, Carl Blackburn, Steve Goins

Carl Blackburn

Vice President/Mortgage Division Manager

NMLS 984008

678-928-8100 or cblackburn@peachstatebank.com

678-928-8100 or cblackburn@peachstatebank.com

Mickey C. Hyder, Jr.

Senior Residential Mortgage Lender

NMLS 168179

678-928-8102 or mhyder@peachstatebank.com

678-928-8102 or mhyder@peachstatebank.com

M. Chase Hyder

Mortgage Lender

NMLS 2076062

678-928-8106 or chyder@peachstatebank.com

678-928-8106 or chyder@peachstatebank.com

Steve B. Goins

Mortgage Lender

NMLS 637833

678-928-8108 or sgoins@peachstatebank.com

678-928-8108 or sgoins@peachstatebank.com

Yemeli Marin

Commercial Lender

NMLS 1457503

678-928-8107 or ymarin@peachstatebank.com

Yo Hablo Español

Ken Crenshaw

Mortgage Originator

NMLS 546221

678-997-3959 or kcrenshaw@peachstatebank.com